Irs Calendar 2024 July 4 – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the a 5.4% bump in income thresholds to reach each new bracket. The IRS . Taxpayers will file their 2024 taxes in early 2025. The IRS increased its tax brackets by about 5.4% for each type of tax filer for 2024, such as those filing separately or as married couples. .

Irs Calendar 2024 July 4

Source : thecollegeinvestor.com

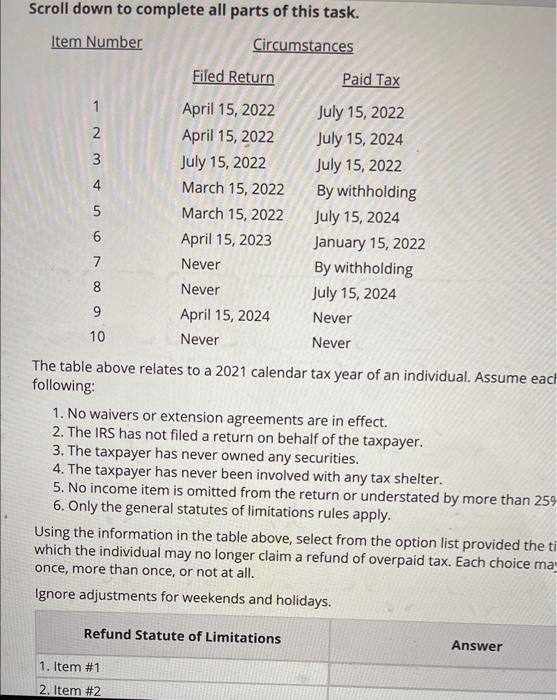

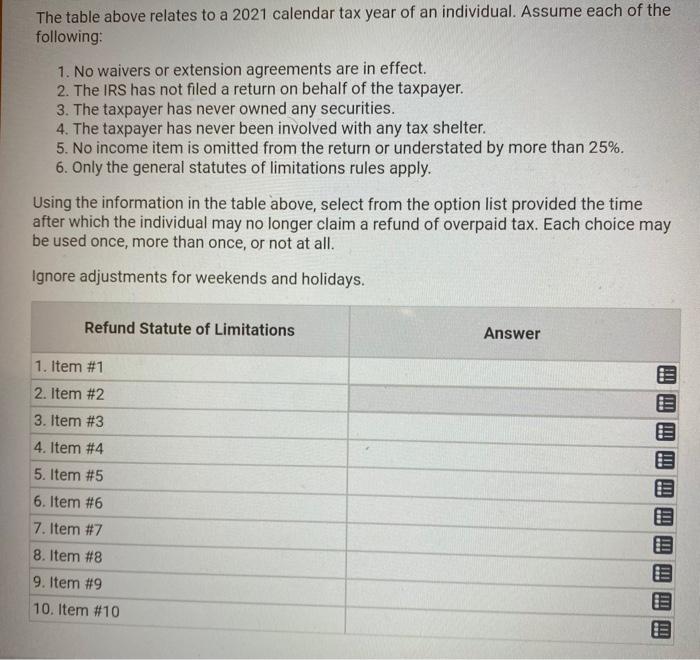

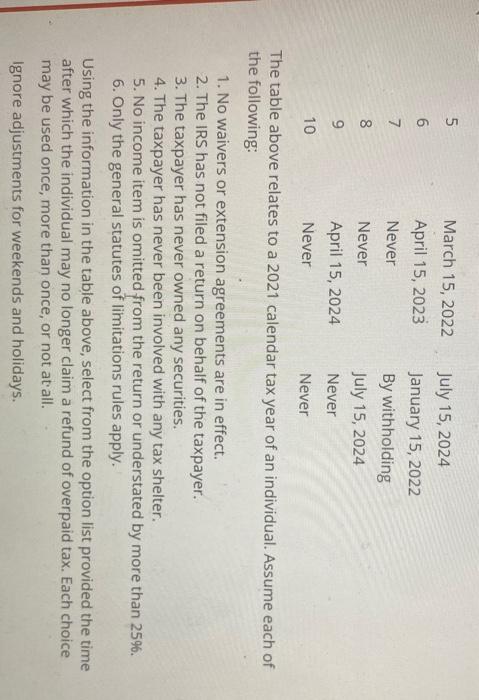

Scroll down to complete all parts of this task. The | Chegg.com

Source : www.chegg.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Item Number Circumstances Filed Return Paid Tax o No | Chegg.com

Source : www.chegg.com

4 5 4 Retail Calendar: Free 2023–’24 Download & How to Use

Source : fitsmallbusiness.com

Solved Item Number CircumstancesThe table above relates to a

Source : www.chegg.com

3.30.123 Processing Timeliness: Cycles, Criteria and Critical

Source : www.irs.gov

The Ultimate HR Calendar for 2024: Holidays, Compliance, & More

Source : verifiedfirst.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

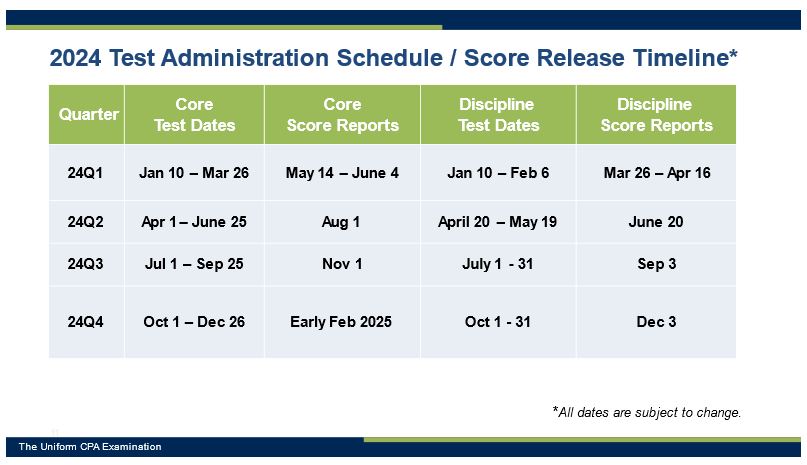

The Current Uniform CPA Examination is Changing Significantly in

Source : www.boa.wv.gov

Irs Calendar 2024 July 4 When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024: They will apply to the 2024 tax year – meaning returns filed in 2025. The IRS makes adjustments to tax It equates to a 5.4 percent bump. For individuals, the new maximum will be $14,600 . The IRS announced new income limits for seven tax brackets on Thursday, providing some taxpayers breaks for 2024. The tax brackets are being adjusted upward by 5.4% using a formula based on the .